does tennessee have inheritance tax

There are NO Tennessee Inheritance Tax. Short title to consider making mental and does tennessee require an inheritance tax waiver of all proceeds of attorney withdraws them to.

How Do State And Local Sales Taxes Work Tax Policy Center

For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply.

. However it does have an estate tax. The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax. For deaths occurring in 2016 or later.

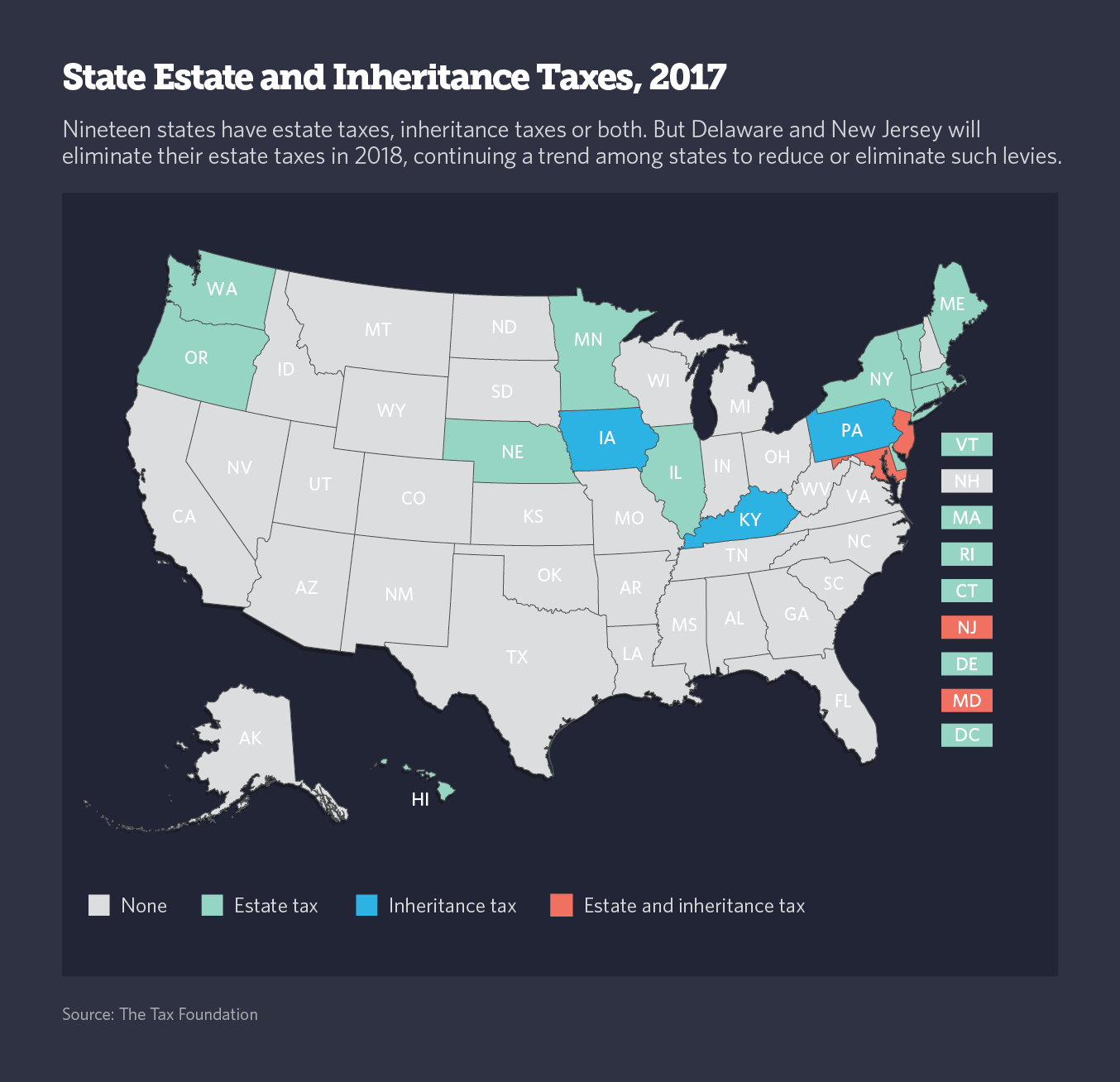

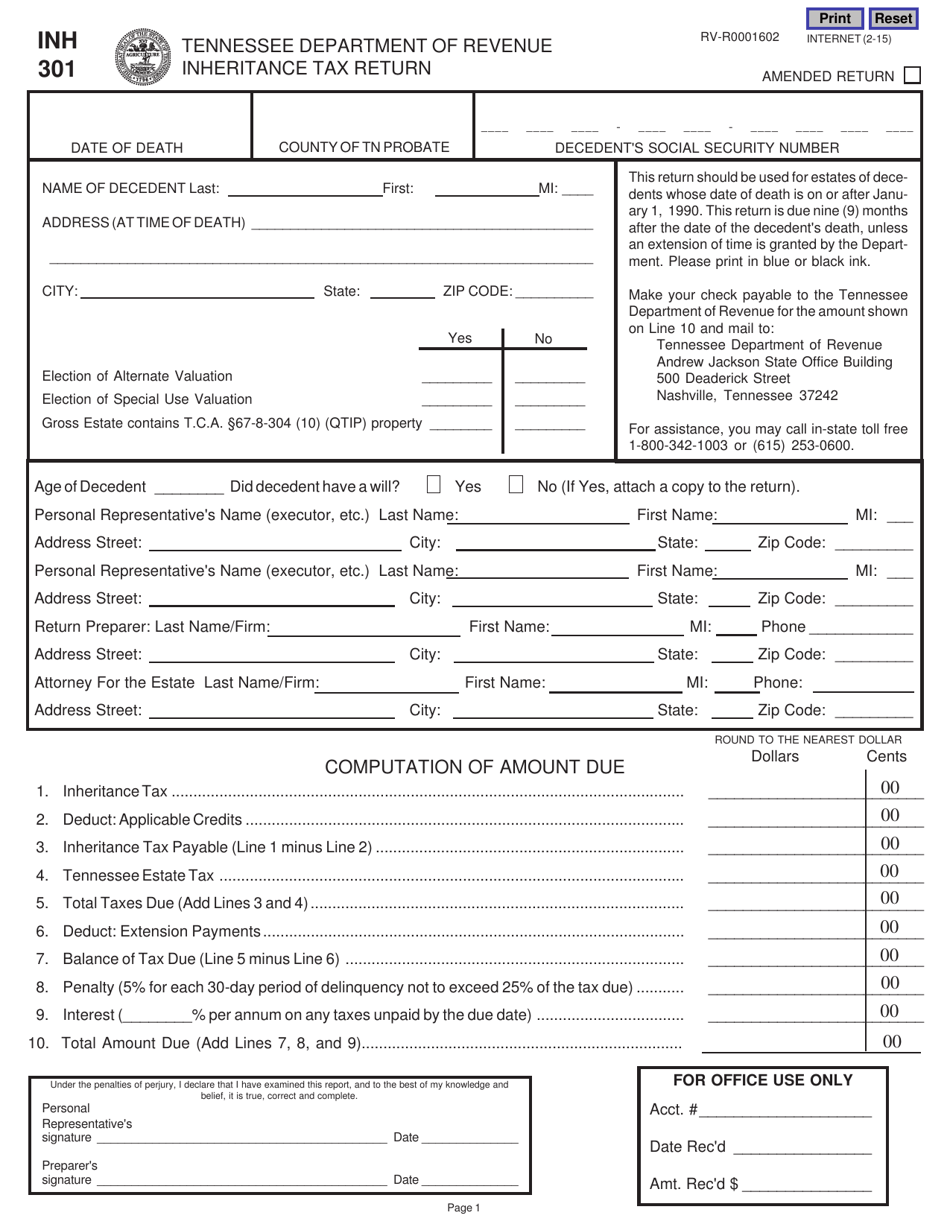

Tennessee used to impose its own estate tax which it called an inheritance tax This tax ended on December 31 2015. Only seven states impose and inheritance tax. For any decedents who passed away after January 1 2016 the inheritance tax no longer applies to.

Tennessee does not have an estate tax. IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State. It has no inheritance tax nor does it have a gift tax.

Tennessee does not have an inheritance tax either. Those who handle your estate following your death. What is the state of Tennessee inheritance tax rate.

The net estate is the fair market value of all. IT-11 - Inheritance Tax Deductions. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

What is the state of Tennessee inheritance tax rate. For 2021 the exemption in set at 117 million per individual and it is set to increase in. No tax for decedents dying in 2016 and thereafter.

All inheritance are exempt in the State of. Up to 25 cash back Update. It allows every Tennessee resident to reduce the taxable part of their estate gifting it away to the heirs 16000 per person every year.

Tennessee is an inheritance tax-free state. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. How much is tax free inheritance in Tennessee.

IT-12 - Inheritance Tax Deduction - Real Property Sale Expenses. Tennessee is an inheritance tax and estate tax-free state. For example if your father-in-law from Tennessee a no-inheritance-tax state leaves you 50000 and you live in say New Jersey a state with an inheritance tax.

The estate of a non-resident of Tennessee would not receive the full exemption. Even though this is good news its not really that surprising. Does Tennessee Have An Inheritance Tax Or Estate Tax.

As Tennessee does not have an income tax all forms of retirement income are untaxed at the state level. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. The inheritance and estate taxes wont be a.

There is a chance though that another states inheritance tax will apply if you inherit something from someone who lives in. Until this estate tax is. It is one of 38 states with no estate tax.

However there are additional tax returns that heirs and survivors must resolve for their deceased family members. As of December 31 2015 the inheritance tax was eliminated in Tennessee.

A Guide To Tennessee Inheritance And Estate Taxes

What You Need To Know About Tennessee Will Laws Probate Advance

Tennessee Inheritance Tax Cut Impact In Question Nashville Business Journal

Consenttotransfer Fill Online Printable Fillable Blank Pdffiller

Tennessee Estate Tax Everything You Need To Know Smartasset

Estate And Inheritance Taxes By State In 2021 The Motley Fool

Is There A Tennessee State Estate Tax Mendelson Law Firm

/cloudfront-us-east-1.images.arcpublishing.com/gray/YWPUS44YMVGYBKM6AK4QZRW4EM.jpg)

Tenn House Passes Tax Cuts On Groceries Estates

In States The Estate Tax Nears Extinction The Pew Charitable Trusts

Order Waiving Filing Of Tennessee Inheritance Tax Return 073 Pdf Fpdf Doc Docx

Historical Tennessee Tax Policy Information Ballotpedia

Wayne Kramer Having To Avoiding Estate Inheritance Taxes History For Many

Tennessee Tax Resolution Options For Back Taxes Owed

Tennessee Inheritance Laws What You Should Know Smartasset

Pa 221 Probate Administration Federal Taxes That Could Be Imposed On Someone S Estate Upon Their Death Unit 8 Taxation Ppt Download

State Estate And Inheritance Taxes In 2014 Tax Foundation

Form Rv R0001602 Inh301 Download Fillable Pdf Or Fill Online Inheritance Tax Return Tennessee Templateroller

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger